Sign in De En Es Ja Zh

Finance Magnates: Ethereum Struggles under the Weight of DeFi Growth: Is ETH Doomed to Fail?

Sep 03, 2020

For a growing number of Ethereum users, the ‘rent is too damn high.’

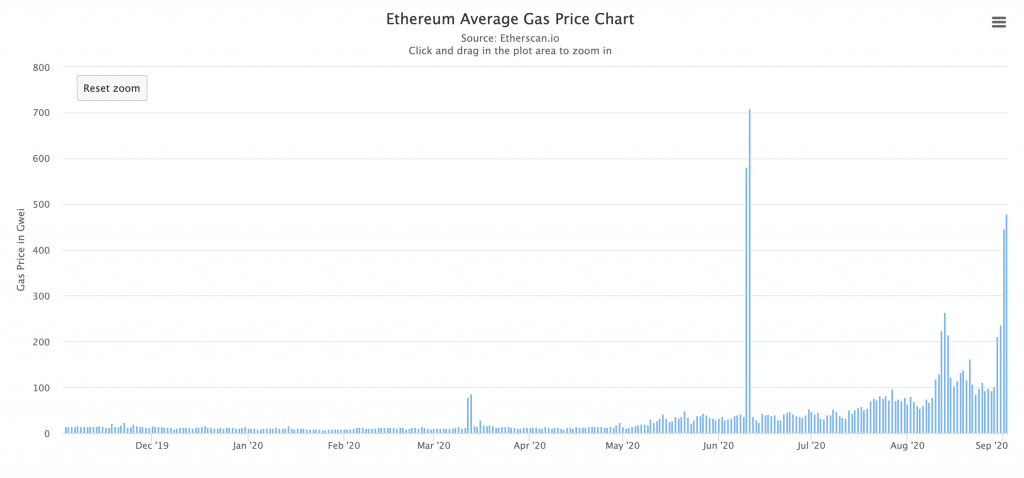

Earlier this week, ETH miners, who are responsible for confirming transactions on the Ethereum network, were raking in cash. According to on-chain analytics firm, Glassnode, miners on the network earned over $500,000 in just one hour on September 1st.

The Most Diverse Audience to Date at FMLS 2020 – Where Finance Meets Innovation

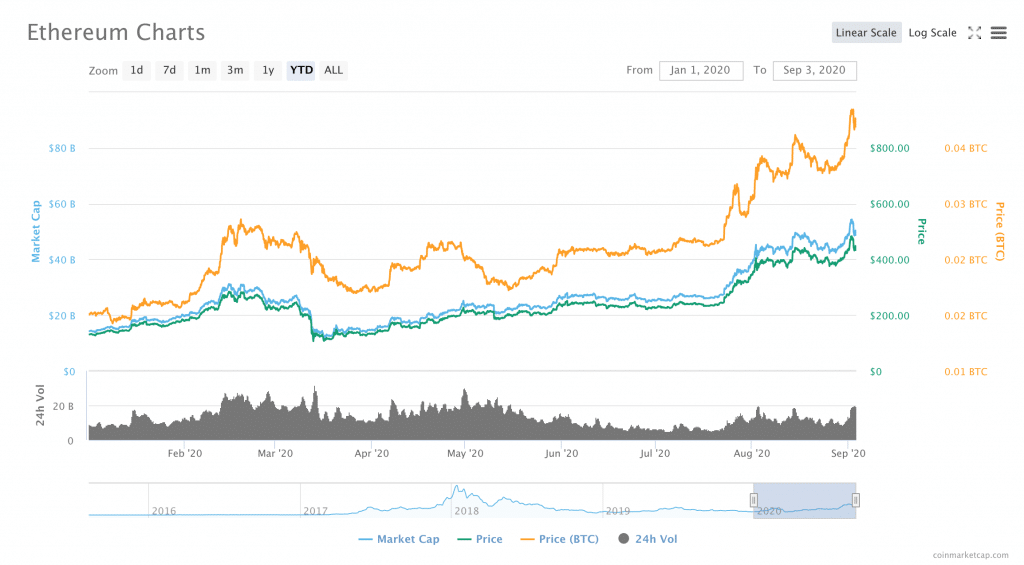

The huge amount of fees was collected as the price of ETH rallied ten percent to $486, a new yearly high. The rally is thought to be related to the launch of Sushiswap, a fork of Uniswap. (Uniswap is a decentralized exchange that exists in the form of two smart contracts on Ethereum.)

Upon its launch, Sushisap hit more than $1 billion in total value ‘locked’ in its platform under 24 hours.

While the price rally and the success of Sushiswap seem like positive things for the Ethereum ecosystem, the deluge of network fees that accompanied the rally is pointing to an increasingly worrisome issue for Ether: congestion.

Is Ethereum Scalable Enough to Support the Growing DeFi Ecosystem?

Indeed, the reason that the network fees went up was because of Ethereum’s popularity: the more users and protocols that the network attracts, the more transactions that are sent through the network. The more traffic there is on the network, the more congested it becomes; as it becomes more congested, fees go up, and transaction times slow down.

A number of Ethereum users and commentators have raised concerns about congestion on the network, saying that Ethereum may not be a viable platform for the continued growth of the decentralized finance (DeFi) sector. After all, much of DeFi’s explosive growth in 2020 has taken place on the Ethereum network.

Open a Trading Account Today With These Recommended Brokers

However, at the same time, Ethereum creator Vitalik Buterin has fired back against critics, saying that second-layer solutions to Ethereum’s scalability problems exist. It is just that people are not using them.

At the same time, Ethereum is moving slowly to the launch of ETH 2.0, a software upgrade that, in theory, should improve the network’s ability to handle high levels of transactions.

However, not everyone is convinced that the layer-two solutions, nor the improvements to the network itself that will happen in the switch to ETH 2.0, will be enough to adequately solve Ethereum’s scalability issues.

The CryptoKitties Incident of 2017 Foretold of Congestion Problems in Ethereum’s Future

Among these Ethereum sceptics is Stuart Popejoy, co-founder and president of blockchain infrastructure firm Kadena. In an email to Finance Magnates, Popejoy called “the demise of the narrative that ETH 2.0 is a viable future platform” the “biggest 2020 development in DeFi.”

Indeed, the increased popularity of DeFi platforms has certainly brought a wave of new activity and new users to Ethereum. However, Dave Parkinson, the Chief Operating Officer of Lamourie Public Relations, told Finance Magnates that “the number of DeFi projects attempting to run simultaneously on the Ethereum network has inevitably exposed the problems with scalability, the way CryptoKitties did a few years ago.”

Ahh, yes. Remember CryptoKitties? The adorable game of trading digital cats that gummed up the Etheruem blockchain so bad that transactions were taking hours, days, and cost a fortune?

At the time, the incident was largely regarded as a fluke. While some analysts pointed out the implications that the CryptoKitties traffic jam had for Ethereum’s future as a scalable (or non-scalable) platform, most Ethereum users watched the congestion pass by without much notice.

“For dApp Developers and Projects, [Ethereum’s High Gas Prices] Are Extremely Worrisome.”

Now, Ethereum users do not have that luxury: “ETH 1.0 is clearly on a warpath to bleed millions of dollars in gas fees over the next couple weeks,” Stuart Popejoy said. “Eventually there will be a new equilibrium when enough gas gets emitted to bring prices back to reality.”

In other words, Popejoy believes that a forthcoming prolonged period of high fees could eventually cause Ethereum prices to go down, and possibly for users and developers to start seeking an alternative platform.

“For dApp developers and projects, [Ethereum’s high gas prices] are extremely worrisome,” Popejoy wrote in a Medium post. “If gas prices are ‘block rent’, immediacy, the ability to transact in some predictable amount of time, is an arbitrary popularity contest.”

In other words, “If you are the developer of an application that provides a time-sensitive service to a minority of Ethereum users, you can find yourself waiting behind a deluge of transactions to serve the latest craze, simply because it is attracting more users than your app. It doesn’t matter that those users represent an entirely different market: your app will still lose based on numbers alone.”

In the long term, these high fees and high congestion levels could fundamentally change Ethereum’s role in the blockchain world, just as scalability issues on Bitcoin network shifted the public perception of BTC from a transactional ‘digital cash’ to a store-of-value ‘digital gold’.

“While Ethereum’s high gas prices seem to only cement Ethereum’s network value, it also inescapably damages Ethereum’s utility as a smart contract platform…expensive gas fees serve to limit the ETH market to rich speculators,” Popejoy wrote in a Medium post, adding that “this is not to disparage DeFi.”

What about Possible Solutions?

However, all hope may not be lost for Ethereum. As Ethereum creator, Vitalik Buterin pointed out, there are existing second-layer solutions that can be adopted to ease transactional flow on Ethereum.

“[…] More people should be accepting payments directly through zksync/loopring/OMG. Seriously, scaling to 2500+ TPS for simple-payments applications is here, we just need to… use it,” he wrote on Twitter.

But why are people not using these solutions?

Suggested articles

Swissquote Joins oneZero EcoSystem to Bolster Liquidity OfferingGo to article >>

Part of the reason seems to be the perception that these second-layer solutions are technically difficult to use. In response to Vitalik’s tweet, one user wrote that “most people do not know how to use those [layer-two] solutions.”

Vitalik responded by saying that “[in my opinion] they’re not hard” to learn.

“They all have a UI on a website that you can go just use; no need to go personally install a new wallet or understand command lines or ZK rollup cryptography or whatever,” he wrote.

However, Vitalik has previously said that up to a certain point, Ethereum users and developers will simply have to adjust to the fact that gas prices may be higher from now on.

Over the weekend, he responded to a Reddit post about increased gas costs with a suggestion that developers were essentially going to have to do more with less: “I do think that contract devs will have to change to adjust to the new reality; the things that you optimize for will be different than they were in the last few years,” he wrote.

“Particularly, minimizing the amount of state that any single transaction needs to read or access is going to become extremely important, but minimizing eg. the amount of computation or the amount of transaction data used (especially the data) will continue to become less and less important.”

‘We can’t be sure’ that ETH 2.0 can carry the growing amount of DeFi projects being developed on Ethereum

As for the ETH 2.0 upgrade, there are mixed opinions over how effective its measures to increase scalability on the Ethereum network will be.

The plan is to implement sharding onto the Ethereum protocol: sharding allows the Ethereum blockchain to be ‘split’ into pieces, which makes it possible for multiple validators to verify multiple blocks of transaction data at once. In other words, blocks of transaction data can be verified simultaneously rather than consecutively. In theory, this should make the network more scalable.

However, some analysts do not believe that sharding will be a good enough solution in the long term: “although upgrading the network in the short term may temporarily alleviate some of the congestion issues, wider adoption of numerous projects now operating on the Ethereum blockchain will compound congestion and scalability issues indefinitely moving forward,” said Lamourie Public Relations’, Dave Parkinson to Finance Magnates.

Similarly, Evgen Verzun, founder of HyperSphere.ai, told Finance Magnates that “we can’t say whether ETH 2.0 update is enough to make the network fast and scalable until it would be launched.”

Part of the issue is that the launch of ETH 2.0 has been postponed a number of times: “this is probably the most frequently postponed update in crypto ever,” Verzun said, a fact that is not without reasonable cause.

Namely, the upgrade includes “a lot of concepts to be implemented,” such as “sharding, Proof-Of-Stake and other features affecting the whole network.”

“Of course, the community believes in Vitalik and the Ethereum developers’ skills,” Verzun said. Still, the DeFI sector is growing so rapidly on the Ethereum network that “we can’t be sure that even ETH 2.0 would be able to carry it.”

Devs May Eventually Look beyond Ethereum

Therefore, at the end of the day, DeFi developers may decide to pack their bags and set up shop on another blockchain.

“If congestion and scalability aren’t adequately addressed in the short term, moving forward I would expect many future projects to be taking a serious look at other blockchains to build their new platforms on like Cardano, TRON, EOS, or any other possible alternatives,” Dave Parkinson told Finance Magnates.

After all, “TRON recently formed a DeFi partnership with Band Protocol, and Cardano is well-positioned to take up the slack left behind by Ethereum with dozens of partnerships and projects planned over the coming months and years,” Parkinson added.

“I expect Ethereum will have some serious competition in the blockchain space for the foreseeable future if they are unable to overcome their current scalability and network congestion issues in the near term.”

However, this level of protocol diversity in the DeFi ecosystem could be a positive thing for the space in the long run: “generally speaking, high fee markets attract competition, which is a net benefit to the health of the broader ecosystem,” wrote Chris Yim, co-founder and chief executive of bitcoin ATM firm LibertyX, in an email to Finance Magnates.

“We can look at what happened to the bitcoin network during the price run-up at the end of 2017. Exchanges and services will have to decide if they eat the fee increase or pass it through to the customer,” he explained.

In the short term, “consumers will ultimately bear the brunt of this through higher transaction fees, delayed transaction times, and failed transactions,” a factor that “also disincentivizes small-dollar transactions which can hurt some of the non-investment use cases.” These can include things like “breeding CryptoKitties, exchanging non-fungible tokenized trading cards, and micro-transactions.”

However, in the longer term, “stakeholders will look at prioritizing more efficient blockchain usage, including batching and whatever they can do to help facilitate [Ethereum’s] delayed shift to proof-of-stake,” which is another aspect of the ETH 2.0 upgrade.

Whether Ethereum continues in its position as the backbone of the DeFi ecosystem or not, it is important to remember that DeFi is still in its infancy. Therefore, anything could happen.